Max Life Savings Advantage Plan

In your life, you may have many goals for which you save money. These may be short term goals, or long term goals. To ensure that you meet these goals like buying a sedan, planning for childs education in an ivy college, planning for your daughter’s destination wedding you need a financial instrument that can systematically save and grow your money.

Presenting Max Life Savings Advantage Plan that will accelerate the growth in your systematic savings and help you build a corpus to address all your life goals while providing for insurance coverage at the same time to take care of your loved ones in case of an unfortunate event.

Plan Benefits

Flexibility To Choose Premium Payment Term And Policy Term As Per Your Need

You have the flexibility to choose from various Premium Payment Terms & Policy Term as per your requirement, enabling you to decide the period for which you wish to save and the time when you need monies to fulfil your particular life stage need.

Guaranteed Additions

This plan provides you guaranteed 5.5% of Guaranteed Sum Assured on Maturity as Guaranteed Additions, at the end of each policy year, for first 5 policy years, to boost your benefits.

Death Benefit That Increases Post 10 Policy Years

In case of death of the life insured on or before completion of 10 policy years, Guaranteed Death Benefit along with accrued Guaranteed Additions, Paid Up Additions (if any) & Terminal Bonus (if any) shall be payable.

In case of death of the life insured after 10 policy years, 110% of Guaranteed Death Benefit along with accrued Guaranteed Additions, Paid Up Additions (if any) & Terminal Bonus (if any) shall be payable.

Maturity Benefit

You enjoy 110% of Guaranteed Sum Assured on Maturity along with Accrued Guaranteed Additions, Accrued Paid Up Additions (if any) and Terminal Bonus (if any).

Settlement and Commutation Benefit

You or your nominee, have the flexibility to convert the lump sum Maturity Benefit/Death Benefit into regular income (monthly or annual mode) for 10 years basis your requirement.

Tax Benefit

You may be entitled to certain applicable tax benefits under section 80(C) and section 10(10D) of Income Tax Act 1961 on the premiums paid and benefits received by you respectively as per the prevailing tax laws. It is advisable to seek an independent tax advice.

How This Plan Works?

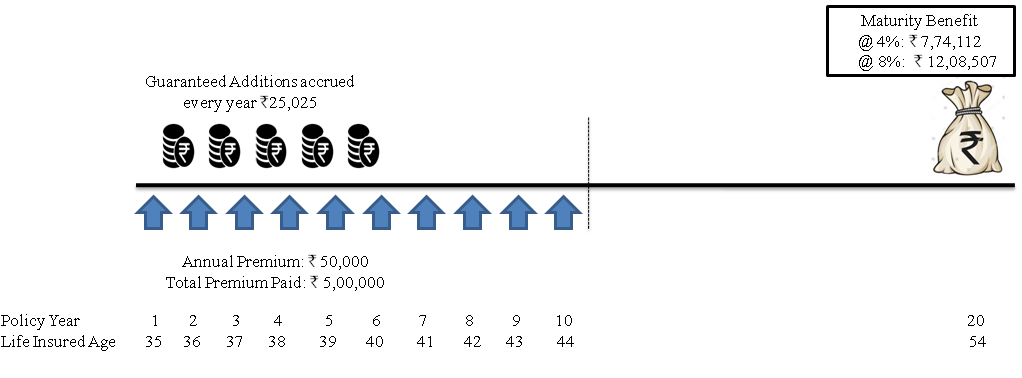

Mr. Bajaj, aged 35 years, pays a premium of Rs. 50,000 in Max Life Savings Advantage Plan on an annual mode. He opts for 10 year Premium Payment Term & 20 year Policy Term. His GSAM is Rs. 4,55,000. Let’s see how this plan would work for him:

Scenario 1: Mr. Bajaj survives through the Policy Term

*Important Notes

1. Kindly note that the above case studies are only examples and do not in any way create any rights and/or obligations. The actual experience of the policy may be different from what is shown above. The above scenarios are depicted at assumed rate of returns with 4% and 8% and these are not the upper or lower limits of what one can expect from this policy, as it is dependent on number of factors including future investment performance.The guaranteed and non-guaranteed benefits are applicable only if all due premiums are paid.

2. You may be entitled to certain applicable tax benefits on your premiums and Policy benefits. Please note that all the tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. Tax benefits are subject to change in tax laws. It is advisable to seek an independent tax advice.

3. Bonuses are non-guaranteed and are declared at the sole discretion of the Company. For more information, please request for your Policy specific benefit illustration.

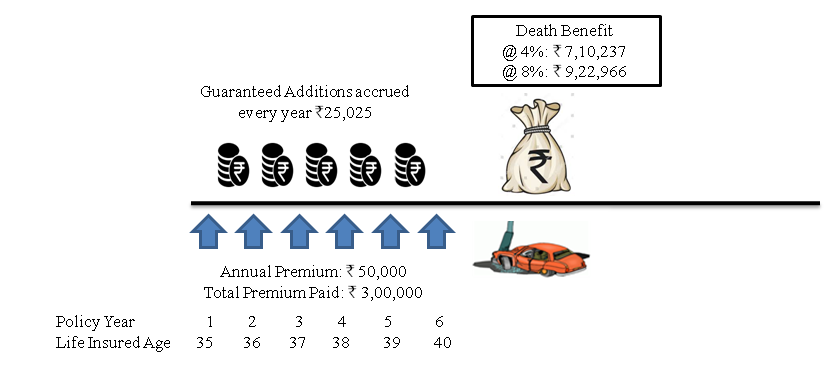

Scenario 2: Mr. Bajaj meets with an accident and dies in the 6th policy year:

*Important Notes

1. Kindly note that the above case studies are only examples and do not in any way create any rights and/or obligations. The actual experience of the policy may be different from what is shown above. The above scenarios are depicted at assumed rate of returns with 4% and 8% and these are not the upper or lower limits of what one can expect from this policy, as it is dependent on number of factors including future investment performance. The guaranteed and non-guaranteed benefits are applicable only if all due premiums are paid.

2. You may be entitled to certain applicable tax benefits on your premiums and Policy benefits. Please note that all the tax benefits are subject to tax laws prevailing at the time of payment of premium or receipt of benefits by you. Tax benefits are subject to change in tax laws. It is advisable to seek an independent tax advice

3. Bonuses are non-guaranteed and are declared at the sole discretion of the Company.

Your Eligibility

Age of the Life Insured at Entry (age as on last birthday)

Minimum

Single Pay : 8 years

Limited/Regular Pay : 0 years (91 days at the time of applying for this plan)

Where the Life Insured is a minor in such a case the proposer should be either parent or legal guardian and must have insurable interest on the life of the minor. The risk coverage for minors will commence from the inception of the policy. Where the Policy has been issued on the life of a minor, the Policy will automatically vest on him on his attaining majority

Maximum

Single Pay : 65 years

Limited Pay : 60 years. If Entry age of Life insured is >=56 years then Entry age of Life Insured + Premium Payment Term shall be <=65 years.

Regular Pay : 45 years

Maturity Age of the Life Insured (age as on last birthday)

Minimum

18 years

Maximum

Single Pay : 75 years

Limited Pay : 80 years

Regular Pay : 65 years

If Entry age of Life insured is >=56 years then Entry age of Life Insured + Premium Payment Term shall be <=65 years.

Premium Paying Options

Premium Payment Term (PPT)

Single Pay

Limited Pay : 5 to 12 years

Regular Pay : 20 to 30 years (where PPT will be equal to PT)

Policy Term (PT)

Single Pay : 10 years

Limited Pay : 10 to 30 years subject to Policy Term being greater than or equal to Premium Payment Term plus 5 years

Regular Pay : 20 to 30 years

Minimum Annual Premium

Single Pay variant: The minimum premium is Rs. 1,00,000.

Limited Pay and Regular Pay variant: The minimum premium varies as per Policy Term and premium payment mode and is shown in table below:

Premium Payment | Policy Term | Policy Term

|

Annual | Rs. 50,000 | Rs. 8,500 |

Semi-annual | Rs. 27,500 | Rs. 6,000 |

Quarterly | Rs. 15,000 | Rs. 4,000 |

Monthly | Rs. 5,250 | Rs. 1,500 |

The minimum premium is exclusive of any applicable tax, cesses and levies, loading for modal premium and underwriting extra premium (if any).

Maximum Annual Premium

No limit subject to limits determined in accordance with the Board approved underwriting policy of the Company

Additional Benefits through Riders

Max Life Term Plus Rider

Add Max Life Term Plus Rider to enhance protection against any unfortunate incident which may cause death.

(For further details, please refer to Max Life Term Plus Rider, UIN – 104B026V03, prospectus)

Downloads

DownloadsMax Life COVID19 One Year Term Rider

Get financial protection from the uncertainty of COVID 19, with a lump sum pay out on COVID-19 diagnosis or death after COVID Diagnosis

(For further details, please refer to the Max Life COVID19 One Year Term Rider Prospectus, UIN –104B048V01) Both Diagnosis and Death Cover is available only for the Life Insured

Downloads

DownloadsMax Life Waiver of Premium Plus (WOP) Rider

Get waiver of all future premiums in case of critical illness/ dismemberment/ death.

(For further details, please refer to the Max Life Waiver of Premium Plus, UIN: 104B029V04, brochure/prospectus)

Downloads

DownloadsMax Life Critical Illness and Disability Rider (UIN: 104B033V01)

Max Life brings a comprehensive insurance plan that covers up to 64 critical illnesses along with total and permanent disability coverage. You can choose the best variant for you from the five available variants. You will be also be eligible for a discounted renewal premium based on the number of steps monitored on Max fit app. You can even choose to get a cover up to age 85 years. (For further details, please refer to Max Life Critical Illness and Disability Rider, UIN – 104B033V01, prospectus/brochure

Downloads

DownloadsMax Life Accidental Death & Dismemberment Rider

Get additional protection cover in case of accidental death or disability.

(For further details, please refer to Max Life Accidental Death & Dismemberment Rider, UIN – 104B027V04, prospectus)

Downloads

Downloads–> Top reasons you should buy this plan

- Flexibility to choose Premium Payment Term and Policy Term that matches your life goals

- Get lumpsum amount on maturity that is partly guaranteed

- Save tax under section 80 C and Section 10(10D) as per prevailing tax laws

- Protection for your family through life insurance cover